income tax rates 2022 south africa

A South African SA-resident company is subject to CIT on its worldwide income irrespective of the source of the income. R216 201 R337 800.

South Africa Personal Income Tax Rate 2022 Data 2023 Forecast

The budget proposes the adjust personal income tax brackets.

. Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time high of 45. The South Africa Revenue Services has published the Rates of Tax for Individuals for the 2022 tax year 1 March 2021 to 28 February 2022 which are as follows. R 38 916 26 of amount above R 216 200 R 337 801 R.

18 of taxable income. Rate of tax R R1 R216 200. R38 916 26 of taxable income above R216 200.

18 of taxable income. Non-residents are taxable on SA-source income. You are viewing the income tax rates.

Reduction in corporate income tax rate and broadening the tax base. 2023 tax year 1 March 2022 28 February 2023 23 February 2022. On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down.

Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate. 40680 26 of taxable income above. Capital Gains Tax CGT See here how the changes in tax rates affect the age groups per income level from last year to this year.

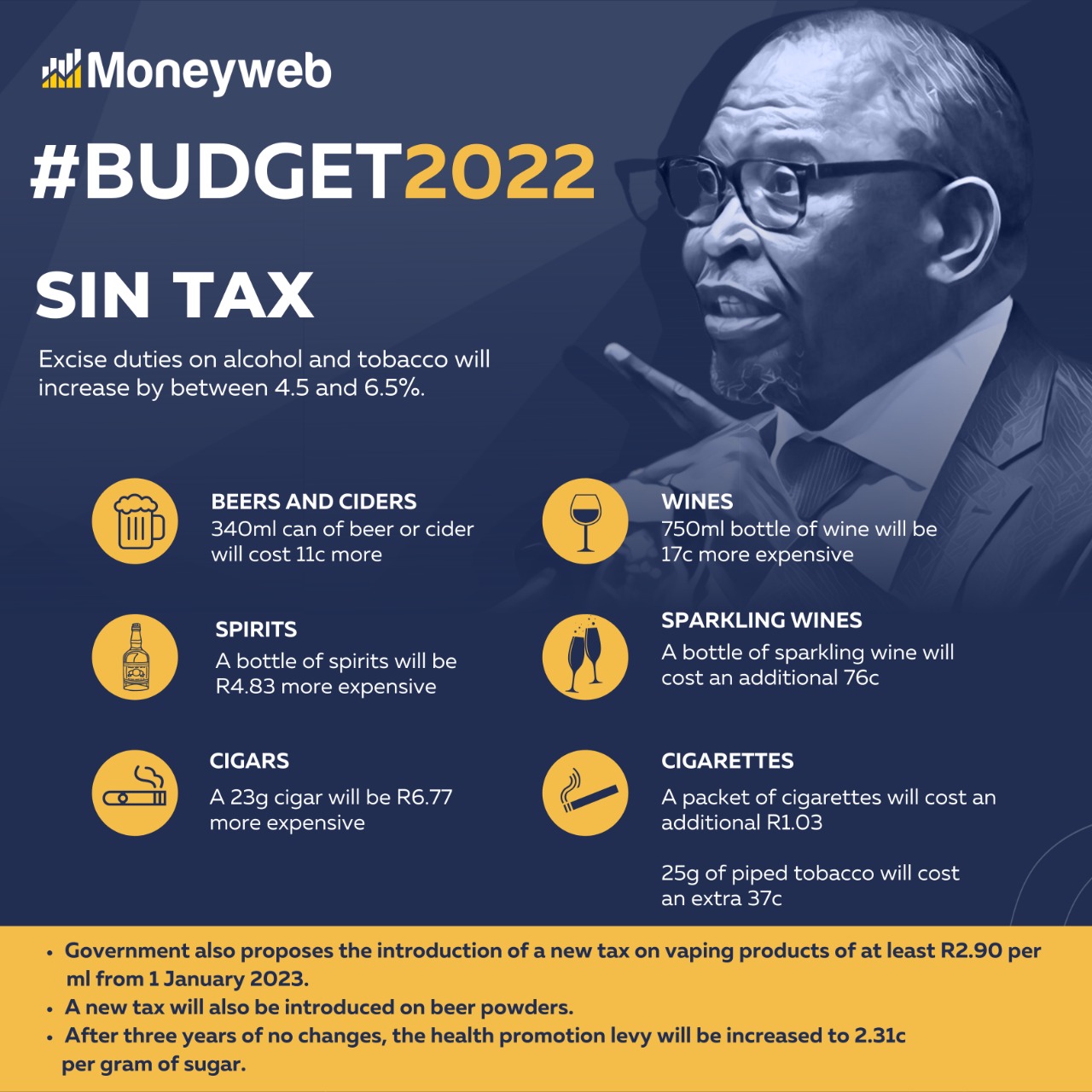

The 2022 budget speech delivered 23 February 2022 announced that the. Deloitte US Audit Consulting Advisory and Tax Services. The Personal Income Tax Rate in South Africa stands at 45 percent.

The South African National Treasury announced on 23 February 2022 that the corporate tax rate is reduced from 28 to 27 for years of assessment that end on or after 31 March 2023. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. R 0 - R 216 200.

Years of assessment ending on any date between 1 April 2022 and 30 March 2023. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. On 23 February 2022 South Africas Minister of Finance Mr Enoch Godongwana presented the 2022 Budget.

Taxable Income R Rate of Tax R 1 91 250 0 of taxable income. Year ending 28 February 2022. Effects of reduced corporate income tax rate on investors in REITs.

You are viewing an example South Africa R4920000 Income Tax Calculation for 2022 2023 Tax Year The below illustration provides a salary calculation for a South Africa resident earning. 01 March 2021 - 28 February 2022. 91 251 365 000 7 of taxable.

R 216 201 R 337 800. 8 rows Non-residents are taxed on their South African sourced income. Information is recorded from current tax year to.

The Minister of Finance in February 2021 announced that the corporate.

What Is The Difference Between The Statutory And Effective Tax Rate

South African Tax System A Guide For Taxpayers Expatica

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

List Of Countries By Tax Rates Wikipedia

Taxes Income Tax Tax Rates Tax Updates Business News Economy 2022

Denmark Individual Taxes On Personal Income

Top 8 Countries With No Income Tax That You Should Know

How To File Your Income Taxes In South Africa Expatica

Taxation In South Africa Wikipedia

Standard Deduction 2021 2022 How Much Is It Wsj

Tax Relief Announcement Good For Individuals Business And Ultimately Sars Too

Income Tax In Germany For Expat Employees Expatica

Us New York Implements New Tax Rates Kpmg Global

State Corporate Income Tax Rates And Brackets Tax Foundation

Who Pays U S Income Tax And How Much Pew Research Center

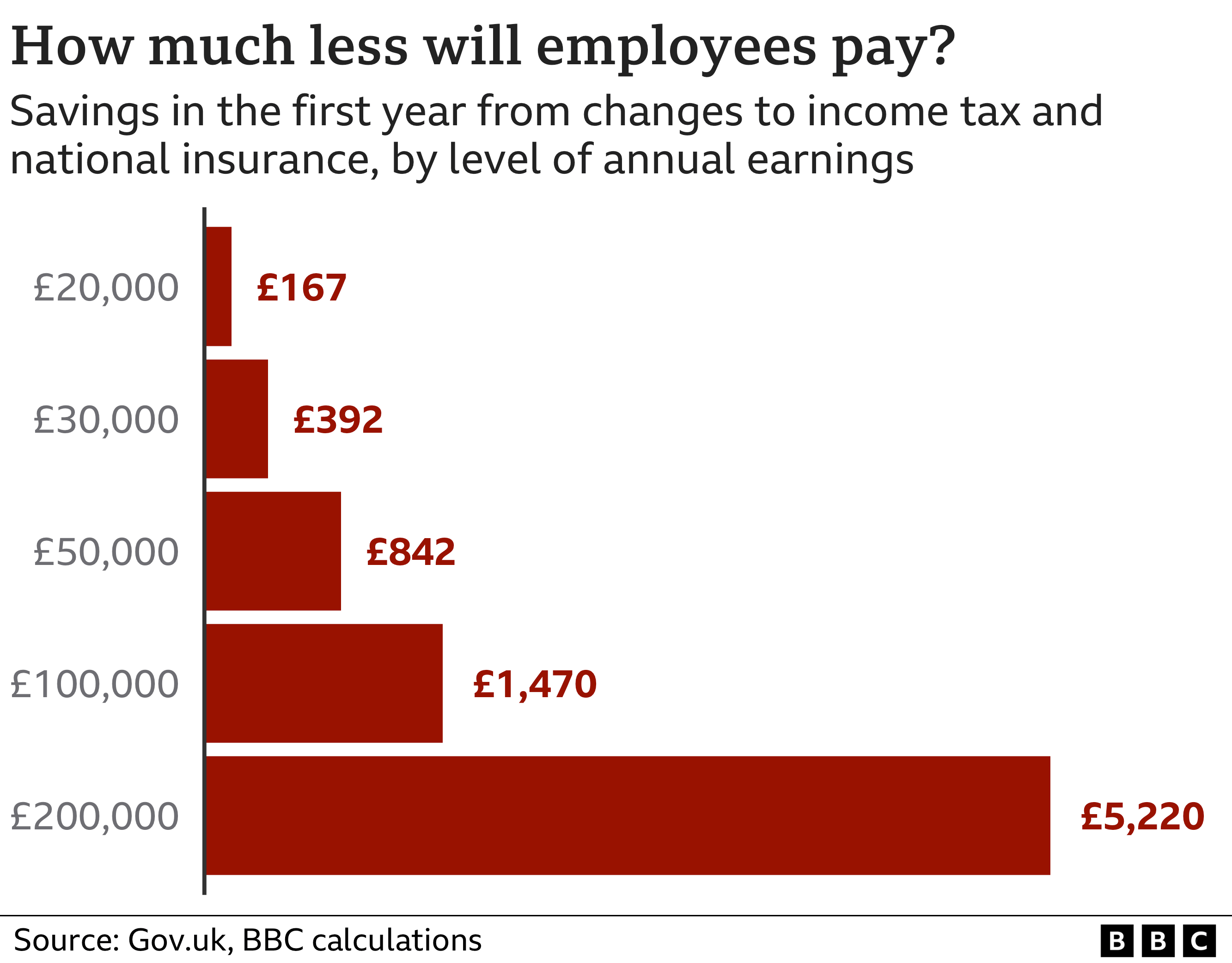

Income Tax To Be Cut By 1p From April Bbc News

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center